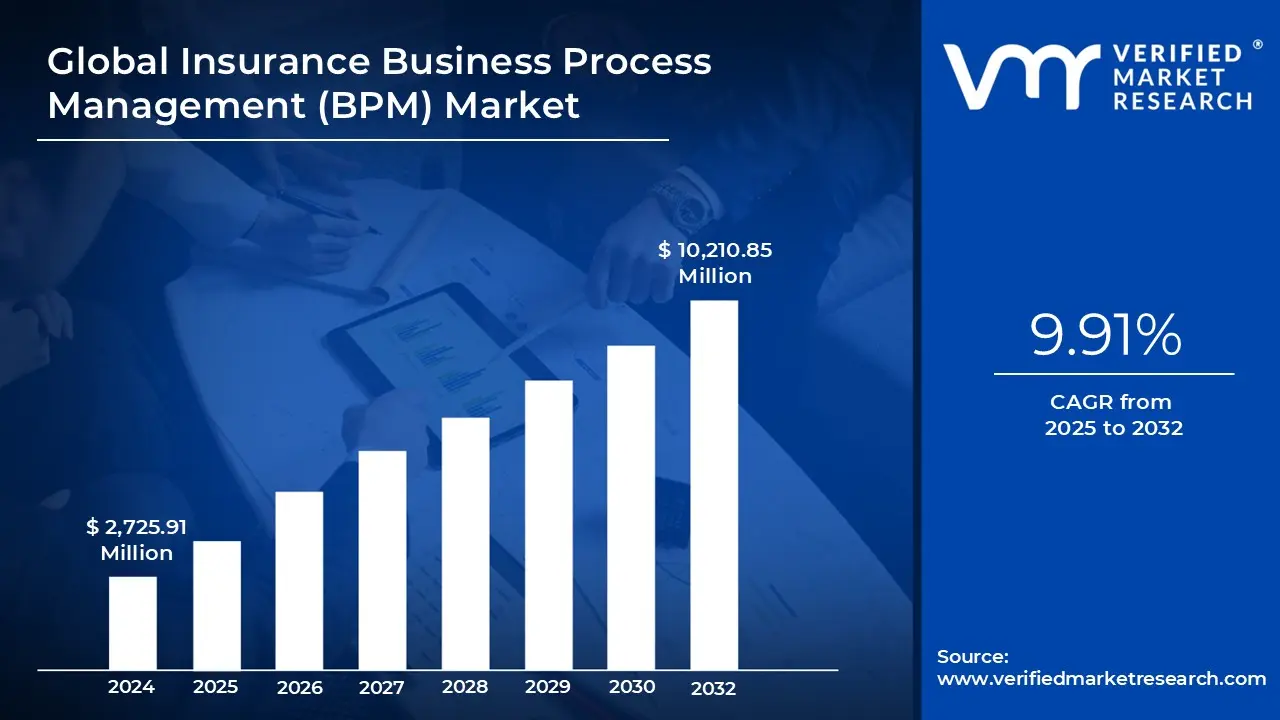

Insurance Business Process Management (BPM) Market expected to generate a revenue of USD 10,210.85 Million by 2032, globally, at 9.91% CAGR: Verified Market Research®

The Insurance Business Process Management (BPM) Market is gaining strong traction as insurers adopt automation, AI-driven workflows, policy digitalization, and claims optimization to reduce costs, improve customer experience, and enhance compliance. However, high implementation costs, legacy system integration challenges, cybersecurity concerns, and skill gaps in digital solutions continue to restrain full-scale adoption.

Lewes, Delaware, Jan. 06, 2026 (GLOBE NEWSWIRE) -- The Global Insurance Business Process Management (BPM) Market Size projected to grow at a CAGR of 9.91% from 2025 to 2032, according to a new report published by Verified Market Research®. The report reveals that the market was valued at USD 2,725.91 Million in 2024 and expected to reach USD 10,210.85 Million by the end of the forecast period.

For a detailed analysis of Industry Trends And Growth Drivers, Explore The Full Insurance Business Process Management (BPM) Market.

For a detailed analysis of Industry Trends And Growth Drivers, Explore The Full Insurance Business Process Management (BPM) Market.

Browse in-depth TOC

202 - Pages

126 – Tables

37 – Figures

Global Insurance Business Process Management (BPM) Market Overview

Market Drivers:

1. Rapid Digital Transformation and Automation Adoption

The Insurance Business Process Management (BPM) Market experiences strong growth as insurers rapidly adopt digital transformation, automation platforms, AI-driven analytics, and workflow optimization technologies. Enterprises focus on accelerating claims settlement, enhancing underwriting accuracy, improving policy administration efficiency, and delivering superior customer experience. BPM solutions enable cost optimization, operational agility, and regulatory alignment, making them essential investment choices for insurance leaders seeking scalable, high-performance digital ecosystems. Organizations implementing BPM gain measurable productivity improvements, better risk control, and improved customer retention — driving greater purchasing intent for market research insights, strategy consulting, and BPM implementation services in the insurance industry.

2. Increasing Focus on Compliance, Governance, and Risk Management

Growing regulatory complexity, evolving insurance compliance mandates, and strict governance frameworks significantly drive the Insurance BPM Market. Insurance providers must efficiently manage audits, data protection standards, customer identity validation, and claims transparency while maintaining operational efficiency. Business Process Management platforms deliver structured workflow control, policy standardization, and automated documentation to support compliance assurance. Companies actively invest in BPM to avoid penalties, strengthen regulatory alignment, and build trusted processes. This market growth propels demand for market intelligence reports, strategic consulting, and digital transformation solutions as insurers seek actionable insights, vendor benchmarking, and technology investment guidance to enhance compliance-driven business performance.

3. Rising Demand for Enhanced Customer Experience and Process Optimization

Customer-centric innovation plays a critical role in accelerating Insurance BPM Market expansion. Insurers increasingly invest in digital platforms to streamline customer onboarding, claims handling, premium processing, grievance resolution, and service personalization. BPM enables seamless workflow integration, omnichannel communication, faster service delivery, and higher policy management transparency. As insurance enterprises compete to retain customers, they prioritize workflow intelligence, automation-led process redesign, and data-driven decision-making. This fuels strong purchasing momentum for BPM platforms, advisory solutions, and strategic research reports that provide competitive advantage, technology roadmaps, and actionable growth strategies for insurers committed to service excellence and business scalability.

Download a free sample to access exclusive Insights, Data Charts, And Forecasts From The Insurance Business Process Management (BPM) Market Sample Report.

Market Restraints:

1. High Implementation Costs and Complex Integration Challenges

Despite strong growth momentum, high initial investment costs and complex integration with legacy insurance IT systems act as major restraints for the Insurance BPM Market. Many insurers still depend on outdated core systems, manual workflows, and fragmented data environments, making BPM deployment technically challenging and financially demanding. Budget limitations, long deployment cycles, and customization complexities slow adoption rates. This creates hesitation among small and mid-tier insurers, impacting enterprise-wide transformation. However, organizations still seek expert advisory, market research reports, and vendor evaluation solutions to mitigate cost barriers and strategically plan BPM investments.

2. Data Security Risks, Cyber Threats, and Privacy Concerns

The Insurance BPM Market faces restraints due to rising cybersecurity threats, data breaches, privacy regulation pressures, and increasing concerns around digital risk exposure. BPM platforms handle large volumes of sensitive customer data, claims records, and financial information, making system security critical. Any vulnerability can result in financial losses, reputational damage, and compliance penalties. Insurance companies remain cautious about migrating core workflows to cloud-based BPM ecosystems. This challenge slows decision-making cycles but simultaneously increases demand for research-backed insights, risk evaluation intelligence, secure BPM vendor assessment, and investment-ready strategy guidance.

3. Skill Gaps, Change Resistance, and Limited Digital Readiness

Another major restraint shaping the Insurance BPM Market is the shortage of skilled professionals capable of managing advanced BPM systems, coupled with organizational resistance to digital change. Many insurance companies struggle with workforce readiness, training limitations, and reluctance to shift from traditional workflows to automated, technology-driven environments. Cultural resistance, lack of BPM awareness, and limited internal expertise delay transformation initiatives. However, enterprises increasingly rely on structured market research reports, strategic consulting, and BPM adoption roadmaps to overcome capability barriers, enhance digital maturity, and execute successful transformation strategies.

Geographical Dominance: North America currently leads the Insurance Business Process Management (BPM) Market, driven by advanced insurance ecosystems, strong digital transformation initiatives, and high technology adoption across the U.S. and Canada. Europe follows with increasing regulatory compliance requirements, automation investments, and mature insurers in Germany, the UK, and France. Meanwhile, Asia-Pacific emerges as the fastest-growing region, led by India, China, and Japan, where insurers aggressively adopt cloud BPM, AI analytics, and workflow modernization to enhance business efficiency and customer experience.

Key Players

The “Insurance Business Process Management (BPM) Market” study report will provide a valuable insight with an emphasis on the global market. The major players in the market are Microsoft Corporation, Ibm, Oracle Corporation, Sap Se, Cognizant Technology Solutions, Newgen Software Technologies Limited, Accenture Plc, Genpact Limited, Pegasystems Inc. (Pega), Appian Corporation, Servicenow Inc., Uipath Inc., Blue Prism Limited, Camunda, Software Ag, Tibco Software Inc., Abbyy, Automation Anywhere Inc., Celonis Se, Tungsten Automation.

Insurance Business Process Management (BPM) Market Segment Analysis

Based on the research, Verified Market Research has segmented the global market into End User, Deployment Model, Solution Type, Functionality/Use Case, and Geography.

-

Insurance Business Process Management (BPM) Market, by End User

- Property & Casualty (P&C) Insurance

- Health Insurance/Medical Benefits

- Individual Life Insurance

- Group Life Insurance

- Reinsurers/MGAs & TPAs

-

Insurance Business Process Management (BPM) Market, by Deployment Model

- Cloud (SaaS/Managed)

- On-Premises

-

Insurance Business Process Management (BPM) Market, by Solution Type

- Robotic Process Automation (RPA) Tools

- Core BPM Platforms (workflow/case management engines)

- Smart Process Automation Suites (BPM + RPA + AI/ML orchestration)

- Low-Code/No-Code Development Platforms

- Intelligent Document Processing (IDP) & OCR Solutions

- Process Mining & Task Mining Tools

- Integration & API Management Tools (ESB/iPaaS)

-

Insurance Business Process Management (BPM) Market, by Functionality/Use Case

- Claims Processing Automation

- Underwriting & Risk Assessment Automation

- Policy Administration & Servicing Automation

- Contact Center & Omnichannel Case Handling

- Customer Onboarding & KYC/AML Workflows

- Finance/Billing & Commission Processing

- Compliance/Audit & Regulatory Workflow Automation

-

Insurance Business Process Management (BPM) Market, by Geography

-

North America

- U.S

- Canada

- Mexico

-

Europe

- Germany

- France

- U.K

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

ROW

- Middle East & Africa

- Latin America

-

North America

Insurance Business Process Management (BPM) Market Strategic Insights:

- The Insurance Business Process Management (BPM) Market is expanding as insurers accelerate digital transformation, automation, compliance management, and customer-centric workflows.

- Key growth drivers include AI-enabled process optimization, regulatory governance, and enhanced service delivery, while high implementation costs, cybersecurity risks, and skill gaps remain major restraints.

- North America leads adoption, Europe strengthens compliance-driven demand, and Asia-Pacific emerges as the fastest-growing region. These dynamics create strong market entry opportunities for BPM vendors, technology providers, and consulting firms to invest, partner, and launch scalable solutions.

- Organizations seeking actionable insights, competitive benchmarking, and purchasing strategies will benefit significantly from this market research.

To gain complete access with Corporate Or Enterprise Licensing, Visit The Insurance Business Process Management (BPM) Market.

Key Highlights of the Report:

- Market Size & Forecast: In-depth analysis of current value and future projections

- Segment Analysis: Breaks down the market by End User, Deployment Model, Solution Type, Functionality/Use Case, and Distribution Channel for focused strategy development.

- Regional Insights: Comprehensive coverage of North America, Europe, Asia-Pacific, and more

- Competitive Landscape: Profiles key players, their strategic initiatives, and innovation-driven growth approaches.

- Growth Drivers & Challenges: Analyzes the forces accelerating growth and the restraints hindering large-scale adoption.

- Challenges and Risk Assessment: Evaluates ethical debates, off-target effects, and regulatory complexities.

Why This Report Matters?

This report empowers market research professionals, insurers, enterprise leaders, consultants, and B2B decision-makers with actionable insights to optimize investments, strengthen digital ecosystems, enhance operational agility, and unlock sustainable revenue growth in the evolving Insurance BPM Market. It supports strategic decision-making, competitive benchmarking, purchasing decisions, and business expansion planning.

Who Should Read This Report?

- Market Research Analysts and Industry Consultants

- Insurance Companies, Brokers, and Policy Administrators

- Technology Providers, BPM Solution Developers, and IT Integrators

- Corporate Leaders, CXOs, and Business Strategists

- Financial Institutions and Digital Transformation Teams

- Investors, Stakeholders, and Business Development Managers

Browse Related Reports:

Global Business Process As A Service (BpaaS) Market Size By Development Model (Private Cloud, Public Cloud, Hybrid Cloud), By Application (Supply Chain Management, Human Resource), By Vertical (Supply Chain And Manufacturing, Consumer Goods And Retail), And Region for 2024-2031

Global Operation Business Process As A Service Market Size By Type (Accounting and Finance, Sales and Marketing), By Application (IT and Telecom, Healthcare), By Geographic Scope And Forecast

Global Intelligent Business Process Management Suites (iBPMS) Market Size By Deployment Mode, By Organization Size, By Industry Vertical, By Geographic Scope And Forecast

Global Business Process Management Market Size By Solution (Automation, Process Modeling), By Deployment Mode (Cloud, On-premises), By Organization Size (Small And Medium-sized Enterprises (SMEs)), By End-User Industry (Banking, Financial Services And Insurance (BFSI)), By Geographic Scope And Forecast

Top AI Business Process Automation & Intelligent Process Automation Companies

Visualize Insurance Business Process Management (BPM) Market using Verified Market Intelligence -:

Verified Market Intelligence is our BI Enabled Platform for narrative storytelling in this market. VMI offers in-depth forecasted trends and accurate Insights on over 20,000+ emerging & niche markets, helping you make critical revenue-impacting decisions for a brilliant future.

VMI provides a holistic overview and global competitive landscape with respect to Region, Country, Segment, and Key players of your market. Present your Market Report & findings with an inbuilt presentation feature saving over 70% of your time and resources for Investor, Sales & Marketing, R&D, and Product Development pitches. VMI enables data delivery In Excel and Interactive PDF formats with over 15+ Key Market Indicators for your market.

About Us

Verified Market Research® stands at the forefront as a global leader in Research and Consulting, offering unparalleled analytical research solutions that empower organizations with the insights needed for critical business decisions. Celebrating 10+ years of service, VMR has been instrumental in providing founders and companies with precise, up-to-date research data.

With a team of 500+ Analysts and subject matter experts, VMR leverages internationally recognized research methodologies for data collection and analyses, covering over 15,000 high impact and niche markets. This robust team ensures data integrity and offers insights that are both informative and actionable, tailored to the strategic needs of businesses across various industries.

VMR's domain expertise is recognized across 14 key industries, including Semiconductor & Electronics, Healthcare & Pharmaceuticals, Energy, Technology, Automobiles, Defense, Mining, Manufacturing, Retail, and Agriculture & Food. In-depth market analysis cover over 52 countries, with advanced data collection methods and sophisticated research techniques being utilized. This approach allows for actionable insights to be furnished by seasoned analysts, equipping clients with the essential knowledge necessary for critical revenue decisions across these varied and vital industries.

Verified Market Research® is also a member of ESOMAR, an organization renowned for setting the benchmark in ethical and professional standards in market research. This affiliation highlights VMR's dedication to conducting research with integrity and reliability, ensuring that the insights offered are not only valuable but also ethically sourced and respected worldwide.

Follow Us On: LinkedIn | Twitter | Threads | Instagram | Facebook

Mr. Edwyne Fernandes Verified Market Research® US: +1 (650)-781-4080 US Toll Free: +1 (800)-782-1768 Email: sales@verifiedmarketresearch.com Web: https://www.verifiedmarketresearch.com/ SOURCE – Verified Market Research®

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.